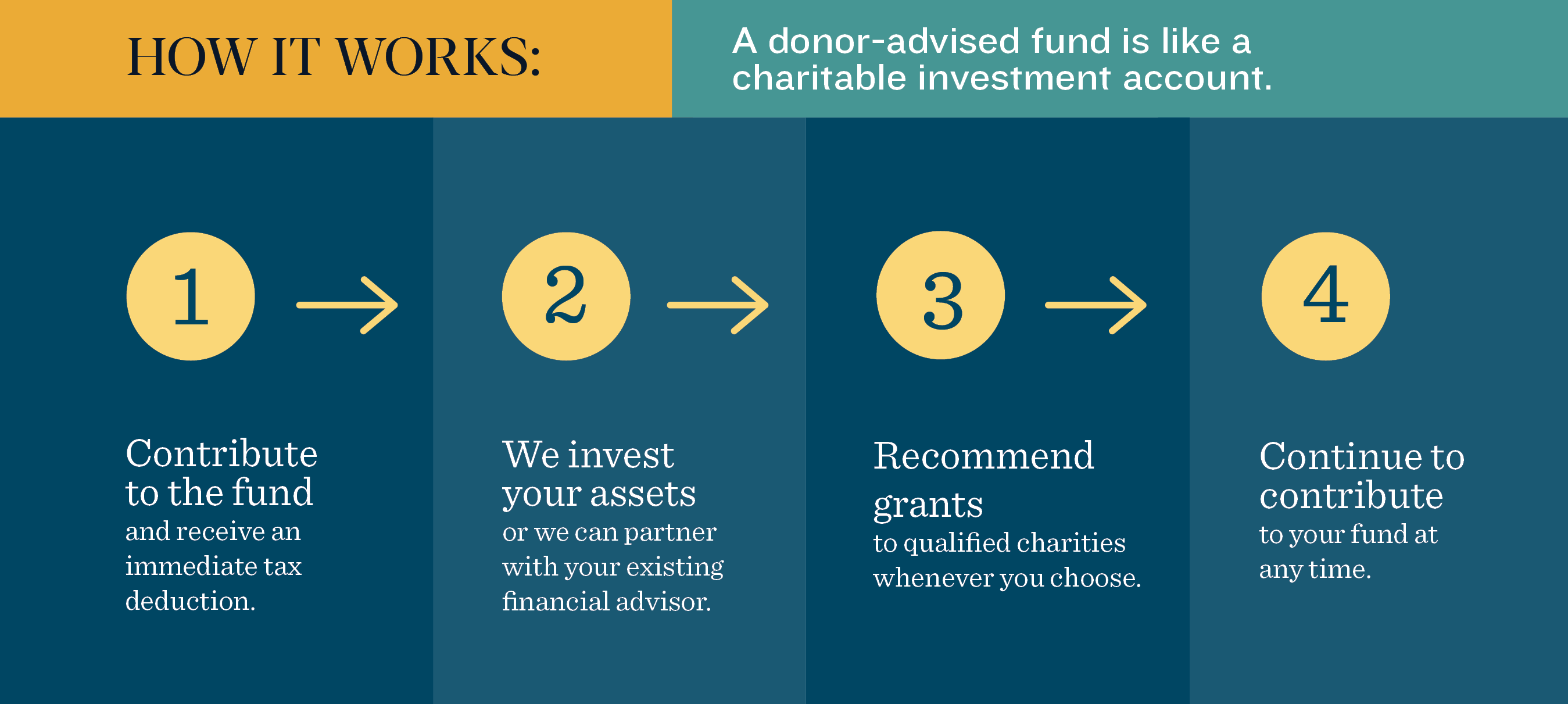

Do you want to shape the future and enhance your giving? Donor-advised funds (DAFs) are an innovative and flexible tool for charitable giving, allowing you to make a real difference in your communities while enjoying tax benefits and personalized philanthropy. Our team of experts will help you maximize your impact and create positive change with donor-advised funds.

Download the DAF BrochureMaximize your impact. Enhance your giving.

Consider a donor-advised fund if you want:

- flexibility, simplicity, and ease

- an immediate tax deduction

- management of your philanthropy from one convenient account

- to support multiple organizations and issue areas

- to streamline and enhance your family charitable giving

- access to our network and knowledge of community

Connect with us.

Do you want to learn more about opening a donor-advised fund? Please complete the contact form or call 303.300.1790 and ask to speak to a member of the Engaged Philanthropy Group.

Through our years of working with The Denver Foundation, their guidance and administrative support have vastly improved our ability to identify recipients and move funds to them in the most efficient manner possible.

The Rollie R. Kelley Family Foundation