Who are agency funds for?

These funds are available to charitable organizations including 501c3 nonprofits, schools, organized houses of worship, and government entities. For many organizations, creating a long-term fund is a path to building their capacity and sustainability. Yet managing a fund can be an administrative burden. When you partner with The Denver Foundation, we’ll serve as an extension of your team, helping you navigate the ins and outs of charitable fund management — and allowing you to focus on the day-to-day work of advancing your mission.

What is an agency fund?

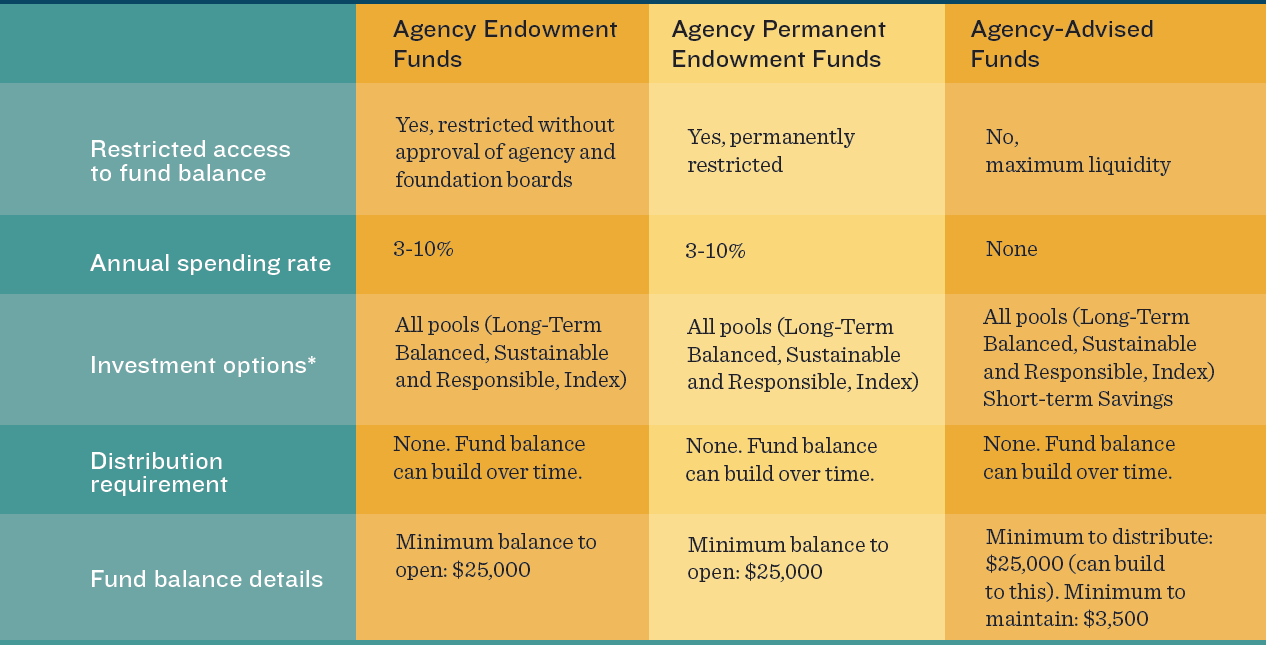

Whether endowed or non-endowed, agency funds help charitable organizations achieve long-term financial stability through sound investments. By establishing a fund, your organization’s assets are invested alongside those of The Denver Foundation and our other fundholders. The Denver Foundation team will help you craft a fund that will support the goals of your organization.

Download our brochure