Many of your clients are successful business owners/creators who will, at some point, need to develop a succession plan. If a client indicates some charitable intent during the early stages of succession planning, The Denver Foundation can help you through that conversation.

“Tax advisors with clients selling a business are always scrambling to find ways to minimize the tax consequences through such devices as discounted family gifts and installment sales while overlooking the extremely beneficial use of charitable split-interest strategies such as charitable remainder trusts and charitable lead trusts,” said L. William Schmidt, a founding member of The Denver Foundation’s Professional Advisors Council. By gifting interests in LLCs, limited partnerships, or closely held corporations, your clients can support charitable causes while also reducing their tax liability. A split-interest arrangement can help to replace some of the income streams lost when a business is liquidated while ultimately benefiting nonprofit organizations a client cares about most.

Why Donate Business Interests?

Maximize Income Tax Deduction

Donating business interests to a fund at The Denver Foundation allows donors to maximize their income tax deduction (typically fair market value, up to 30% of AGI) reducing income tax liability in the year the gift is made, and up to five additional years.

Avoid/Reduce Capital Gains and/or Estate Tax

Pre-sale donation of business interests can reduce or eliminate capital gains tax liability, thus furthering the impact of your donor’s philanthropic gift. Gifts made during a lifetime remove the assets from the donor’s estate and help reduce potential estate tax liabilities.

Business Interests as Charitable Gifts Over Time

Business Interests as Charitable Gifts Over Time by The Denver Foundation

Gifts of business interests are subject to complex tax considerations, and timing is often a critical factor. It is crucial that charitable donations of business interests be made before there is a signed agreement with a prospective buyer. Donors must follow IRS rules regarding qualified appraisals in order to substantiate any tax deduction.

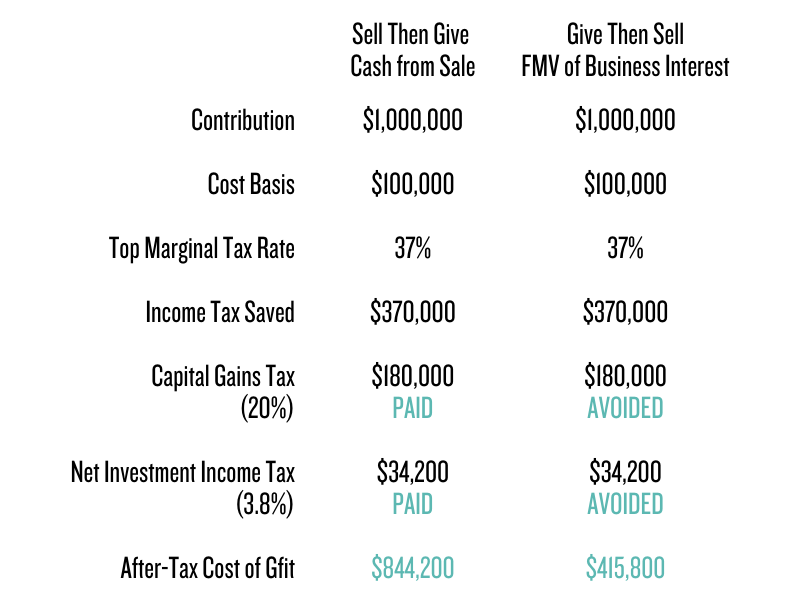

Sample Tax Benefits Before vs. After A Sale

This table compares the after-tax cost of a cash donation of $1M following the sale of a business interest with a FMV of $1M and a cost basis of $100,000 with the tax savings that result if the donor had made a pre-sale gift instead.

Donating business interests pre-sale often results in significant capital gains tax avoidance in addition to the charitable income tax deduction available with post-sale gifts of cash.

The Denver Foundation’s expert philanthropic team can help you help clients to make these transformative gifts. Please contact Rachel Spory-Leek, Planned Giving Officer, at rsleek@denverfoundation.org, 303-996-7340.